Protect sensitive information and keep your business secure against data leaks with trusted payroll software

Managing company accounts in an increasingly remote and blended working environment can be a challenge for business owners and accountants alike. We chat with Tlou Ledwaba the Managing Director of Bright Path Business Consultants to get a closer look at the importance of payroll security.

When it comes to managing your payroll, it can be hard to ensure that all that delicate data is managed and safeguarded securely. And with the added element of a remote workforce, keeping payroll data protected becomes even more complex when handling shifting office spaces.

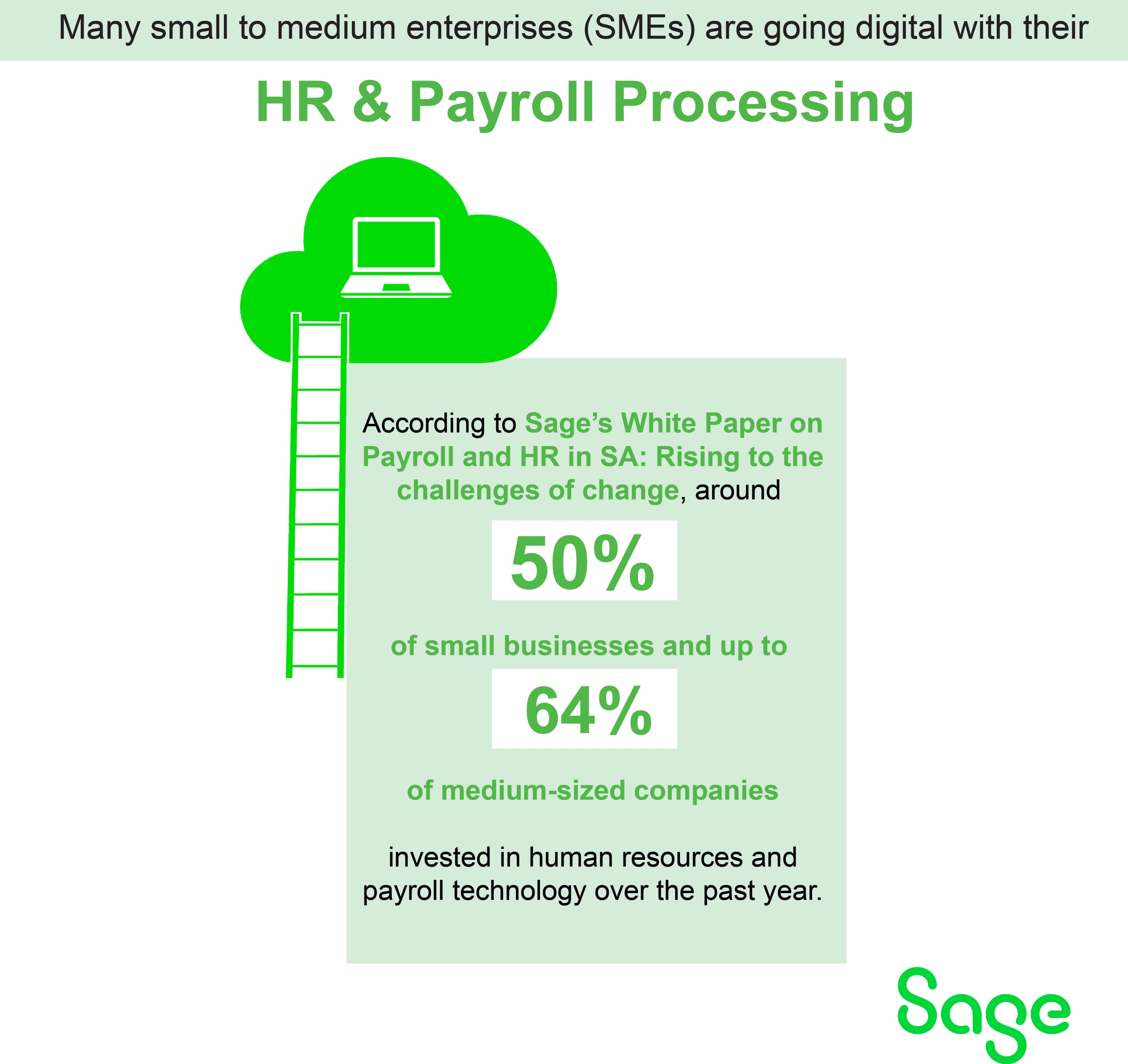

This is where companies should look at tightening payroll security as it plays a vital role in keeping company and employee data safe and sound. With the Covid-19 pandemic forever shifting the working world to remote and blended models of company structures, many small to medium enterprises (SMEs) are moving their HR and payroll processes onto digital systems.

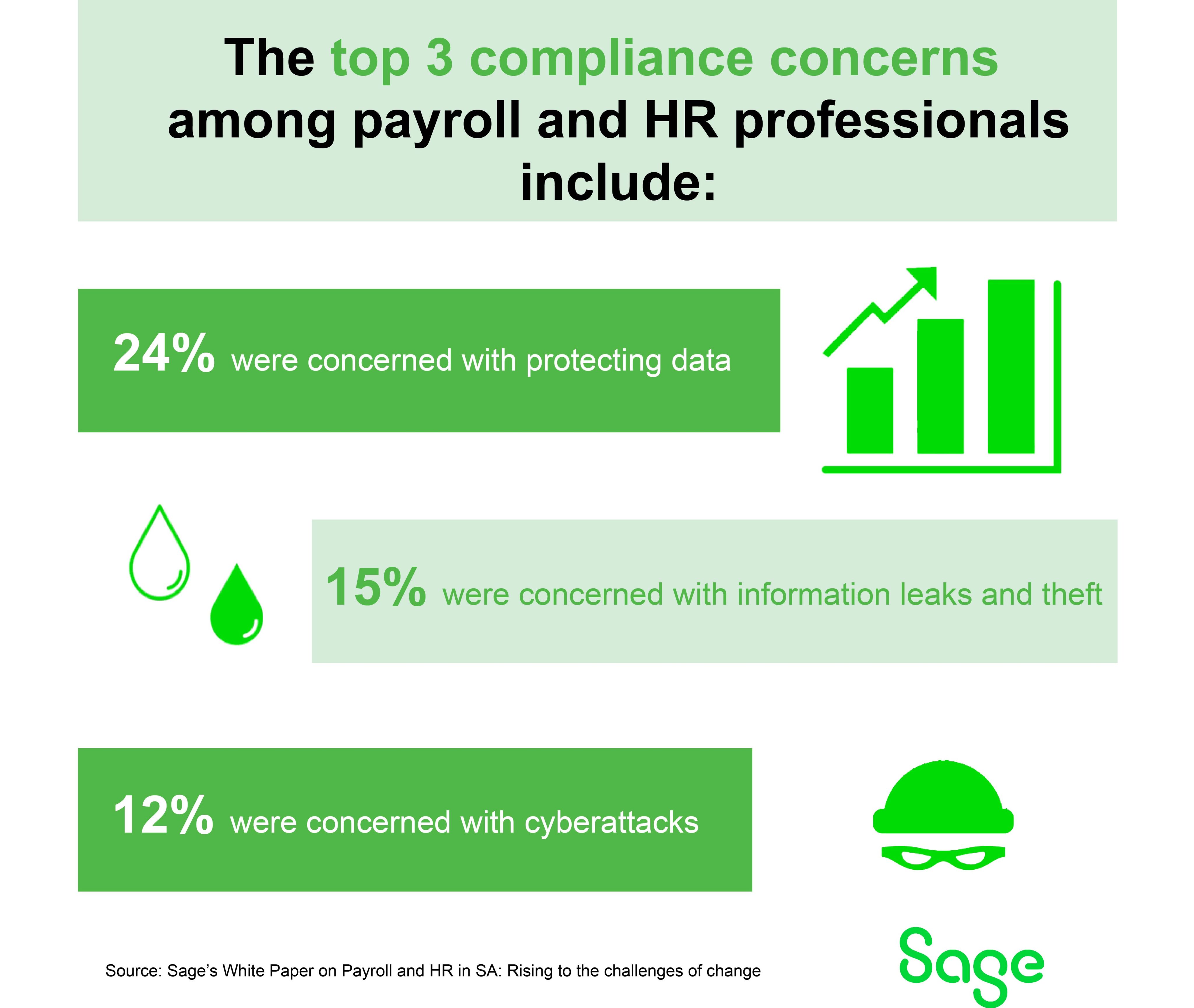

Cyber threats and risks of phishing are an increasing concern for many companies opting to digitise their sensitive data. Add to that an increased awareness around data security thanks to the important Protection of Personal Information Act (POPIA).

These threats became a challenge for business owners and accountants alike. Both had to consider cloud-based solutions and pivot their processing strategies to help keep company and employee data secure in any working environment. To help learn more, we spoke to Bright Path Business Consultants Managing Director, Tlou Ledwaba, to unpack the importance of payroll security and how accountants can help their clients stay compliant and secure while still going digital.

“Payroll security is more important than ever, some of the factors that heightened the urgency include the constant evolution of cyber threats and the complex business environment businesses operate in. It is of paramount importance, for companies of all sizes to ensure that adequate systems and controls are implemented to safeguard the highly sensitive and confidential payroll data,” says Ledwaba.

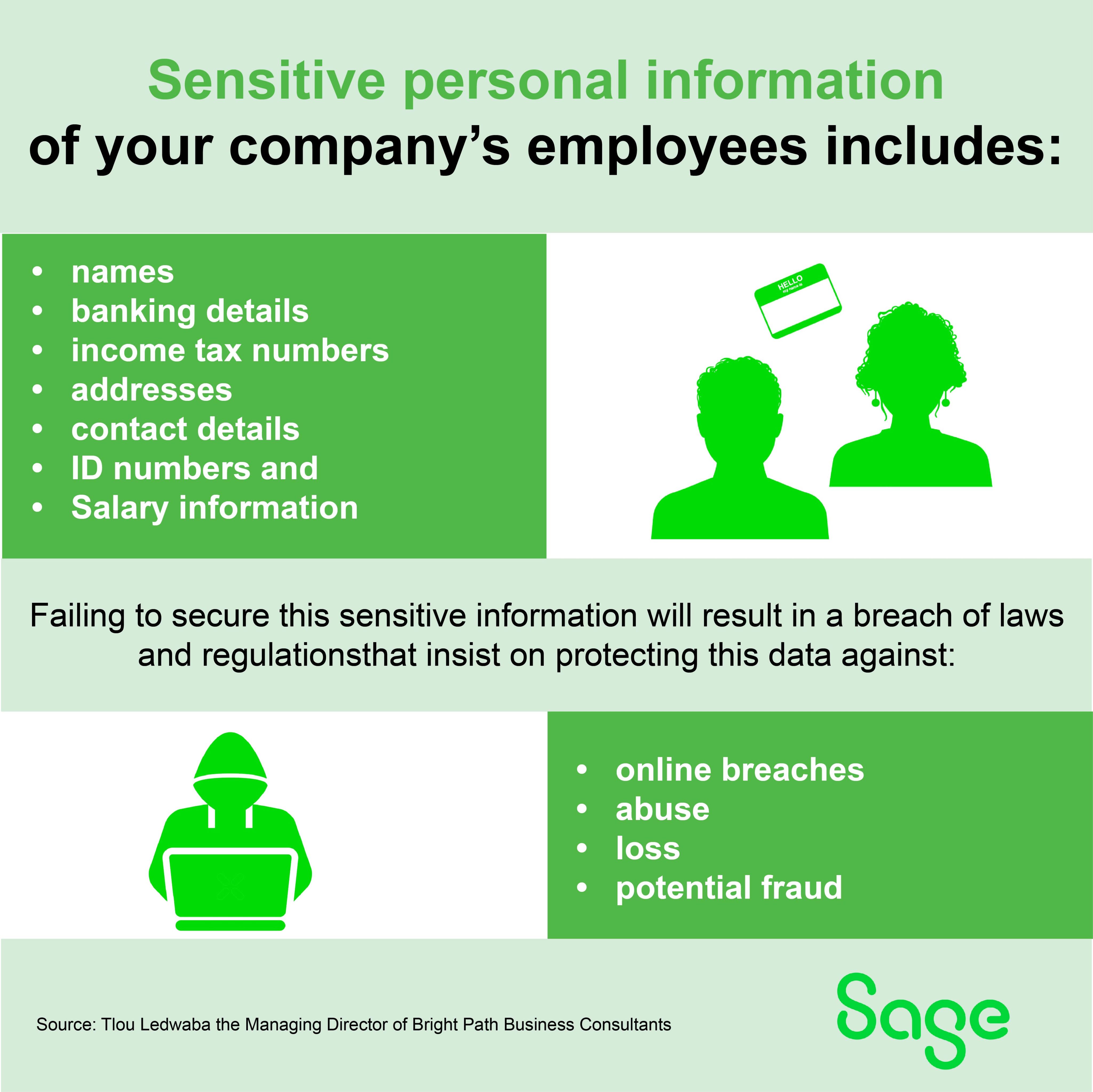

When considering the potential risks of not ensuring payroll security, Ledwaba adds that not processing your payroll safely can put sensitive personal information, that falls under the POPIA ruling, of your employees at risk.

Ledwaba explains the Bright Path Business Consultants team ensures payroll security by providing payroll and HR advisory services. Through these, they train their clients to successfully design and implement payroll security measures.

“We have, over the years, developed internal controls and policies to address our clients’ needs and responses to identified risks. Our processes are well defined to manage access to the payroll systems, segregate duties within payroll team, perform peer review and approvals of key information changes, review payroll reports and run regular system updates and keep back-ups of payroll information,” Ledwaba adds.

“Digital transformation has provided a great relieve and support to ensure payroll security,” Ledwaba explains. “A perfect example of this is the awesome Sage Cloud Payroll system we use at Bright Path Business Consultants, the available standardised features hold a higher degree of payroll security and provides online logs to trace any data manipulation.”

Ledwaba goes on to add this online platform provides immediate system updates, integration, as well as online confidentiality – which is why they use this platform when helping their client companies manage their payroll processing.

This is because cloud-based software like Sage’s constantly monitors and protects its infrastructure. These types of software often come with built-in security measures like encryption, access restrictions, and other data protection processes that prohibit unauthorised people and cybercriminals from accessing confidential data. You can find out more about Sage Business Cloud Payroll Professional software here.

In closing, Ledwaba shared the following nugget of wisdom for other accountants and small businesses looking to tighten their payroll security and processing:

There is no one size fits all approach we can project for all circumstances, however it is always important to obtain professional advice from a qualified business consultant who will zoom deep into the company’s specifics and recommend the best solutions. The assessment we normally perform at Bright Path Business Consultants normally provides a clear direction into what decisions should be taken around what payroll systems should be used, controls to be designed and what should be managed internally and what should be outsourced to ensure the payroll integrity and security.

To strengthen your business, find out more about Sage products and services here.