WATCH | The Lessons of the Cyber War Frontier

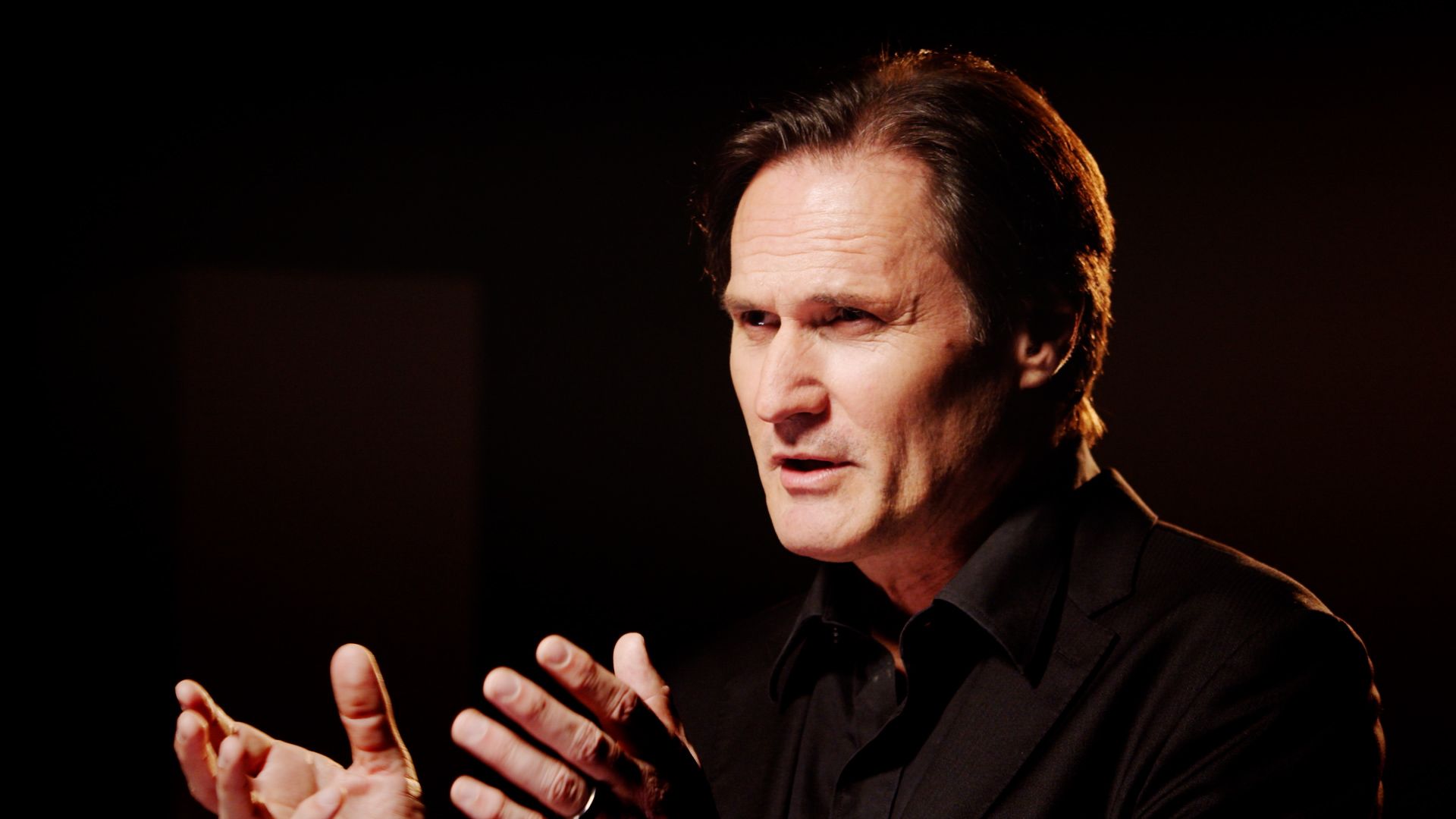

A talk by Pieter Geldenhuys | Innovation expert and futurist

In this episode, Pieter Geldenhuys - Director of the Institute for Technology Strategy and Innovation - looks at how cybercrime technology has evolved over the years and what this means to the security of our personal and business information.

The digital and technological advancements we have seen in the last decade alone have made our lives easier, faster and more connected than ever before. The generations growing up in this golden age have digital connectivity engrained into their DNA and everything they need is just a click away.

A market insight report on the Internet of Things (IoT) found that the number of global IoT connections grew by 8% in 2021 - to 12.2 billion active endpoints. While all this growth and advancement is sure to make our lives even easier, it also presents a growing threat to the security of our personal information.

In this episode of Nedbank’s Ahead of the Curve, Pieter Geldenhuys - Director of the Institute for Technology Strategy and Innovation - looks at how cybercrime technology has evolved over the years and what this means to the security of our personal and business information. Geldenhuys’ talk titled ‘The Lessons of the Cyber War Frontier’ also looks at:

- Zero trust networks and Covid-19.

- The Role of Artificial Intelligence (AI) in cyber security.

- Unlocking new value in the ecosystem.

Over the years we have seen cybercrimes develop alongside technology - from Cold War tactics like passive listening devices to full-scale attacks that have threatened to crash banking systems and topple global economies. Global forecasts indicate that by 2028 the cost of cybercrimes will have increased for the fifth consecutive year to $13.82 trillion.

"A glance at the cyber threat map will highlight the constant challenges faced by IT Departments on a second-by-second basis. Now let's embark on a brief journey through the past, the present, and the future of cybersecurity," says Geldenhuys.

Zero trust networks

This evergrowing multi-trillion dollar industry means that cyber security needs to become more proactive and the idea of firewalls keeping a network safe should no longer be seen as the primary defence.

"Remote work, which exploded under Covid-19 has forever changed the idea of protected networks. Remote access devices have multiplied their tech vectors available to hackers. The reality is this, organisations need to assume that a breach has already taken place and that the enemy is already inside the gates. The focus should now be on protecting the crown jewels. Trust is a dangerous vulnerability that is exploited by malicious actors. It is time to embrace zero-trust networks where you trust no one inside or outside your network," he says.

Zero-trust networks are a security framework that mandates that before granting or maintaining access to applications and data, all users - whether inside or outside the organisation's network - must first authenticate, authorise, and undergo ongoing security configuration and posture validation.

"Embracing zero-trust networks where trust is not granted by default and only selected individuals have access to critical data is crucial. A layered approach with continuous monitoring and an adaptive environment is required for effective cybersecurity. The primary focus is now the integrity of the data in the organisation," says Geldenhuys.

Pieter Geldenhuys | Director of the Institute for Technology Strategy and Innovation

Pieter Geldenhuys | Director of the Institute for Technology Strategy and Innovation

The role of AI

Geldenhuys believes that where we are lacking in cybersecurity professionals, AI can help fill that gap.

"Artificial intelligence can play a vital role in leveraging its superior pattern recognition capabilities to assist cybersecurity personnel in tracking intrusions and implementing proactive protection.

AI pattern recognition can be used very effectively in searching for new patterns in the millions of computer logs generated every single day by our computer networks," he explains.

Unlocking new value in the ecosystem

While Geldenhuys advocates for the positive role of AI, he in the same breath acknowledges how it can also be used by hackers. To circumvent this he says we need to move beyond the visible and into the world of the quantum.

"Quantum computers pose a dual threat and opportunity. They are expected to crack the prime numbers underlying our modern encryption technology at an unprecedented speed in the not-too-distant future. This event is called the post-Quantum Cryptography era, and IT professionals are busy altering their procedures and practices similar to the Y2K challenge a few years ago," he says.

The future

As the race to further technological advancements and cybersecurity continues, so too will a more philosophical predicament arise.

"Will we witness our harmonious equilibrium between security and privacy, or will the scale tip towards a more intrusive surveillance state? How can we strike the delicate balance between innovation and risk mitigation knowing that the very techniques that empower us are the ones exploited by malicious actors?" asks Geldenhuys.

While the future may be uncertain, the growing demand for businesses to handle people’s personal information with care will remain a constant.

"As society becomes increasingly reliant on digital infrastructure and interconnected systems, the need for robust cybersecurity measures becomes paramount," Geldenhuys says.

His sentiments are shared by Pascalle Albrecht - National Head: Commercial Card Strategy, Nedbank Commercial Banking who said: "Businesses are under a lot of scrutiny to keep clients' data safe and secure and being prepared for cyber threats, so response plans are now becoming non-negotiable."

Nedbank’s commercial banking team have taken great steps to ensure that their client’s data is protected and safe. Partner with Nedbank Commercial Banking on your digital journey HERE and find out more about how banking can be made safer when partnering with the green bank.