Choosing solar: Buy for savings or rent for flexibility?

To buy or rent solar? That's the question for many South Africans as solar energy adoption gains traction. Buying could mean big savings over time, but renting remains a low-commitment option over shorter periods.

The shift to solar energy in South African homes and businesses has undoubtedly grown over the years due to power outages and the continued above-inflation rise in electricity tariffs. According to the National Energy Regulator of South Africa (NERSA), a total of R11.4 billion has been invested in solar PV technology.

"We have certainly seen a shift in how households approach solar installations, with the focus now turning to the potential for significant savings on their monthly electricity bills. There is now widespread evidence that South African households are achieving significant savings on their electricity bills from their solar installations and that this is helping to offset any finance or rental costs."

The growing appetite for solar has raised the question: Is it better to buy or rent a home solar solution? While there are a few ways to consider the payment options available for buying or renting solar panels, LookSee's Du Plessis says it depends entirely on your circumstances.

"If you’re a tenant or planning to sell your home within the next three to five years, then a rental option might be preferable due to its lower monthly payments. However, if you’re expecting to be in your home for the long term – say five to ten years – then ownership is undoubtedly the best option for your family because once you pay off your finances, you get the full advantage of the electricity savings potential," he explains.

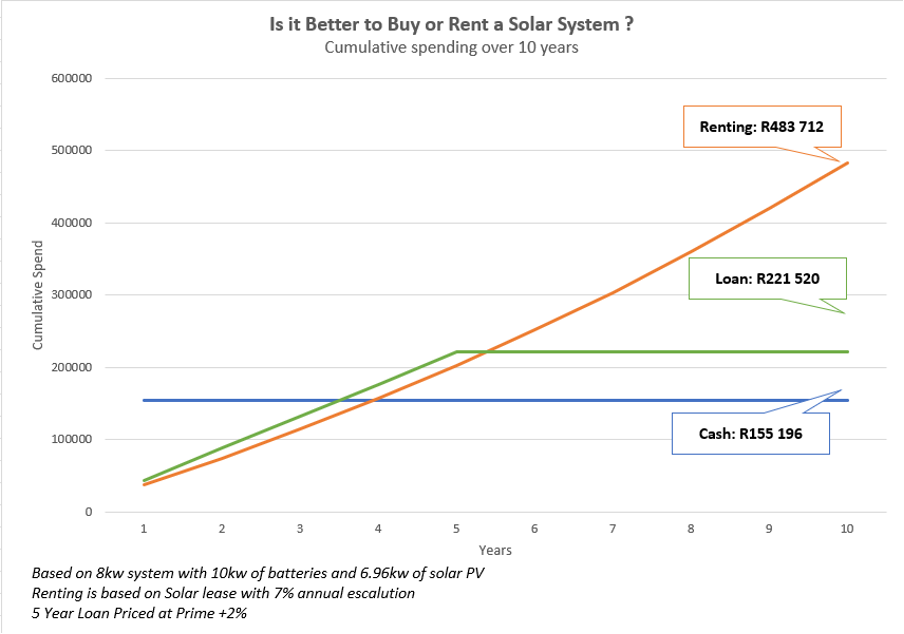

To help you understand the cost implications of buying versus renting, LookSee has created a chart demonstrating how the cost of acquiring an 8-kilowatt solar system changes over time through various finance options.

"You can see that renting is more cost-effective than a financed solar solution for just over five years. After this point, renting becomes increasingly more expensive, particularly when you consider that once your solar loan is paid off, the savings on your electricity bill go straight into your pocket," Du Plessis explains.

Pros and cons

While cost is commonly at the forefront of customers' minds when considering a solar installation, Du Plessis notes there are other factors that should also be considered to make an informed decision. These are included in the table below:

|

|

Financed solar system |

|

Pros |

· Long-term financial gain from free electricity when loan is paid off · Electricity bill savings can help you pay off your loan · Return on investment · Finance options with low interest rates · No annual increases, benefit from interest rate cuts · Sell electricity back to your municipality · Increased property value · Customised to your needs · Long warranty periods |

|

Cons |

· High upfront costs · Higher monthly repayments until loan is paid off · Repayments will go up if interest rates go up · Maintenance and servicing if needed |

|

|

Rental solar system |

|

Pros |

· Low upfront costs · Lower monthly payments · Electricity saving savings can help you pay your rental costs · Maintenance and repairs covered by service provider · Increased flexibility if you are renting your home or are planning to move in the near future |

|

Cons |

· Annual increases in rental costs · Higher long-term costs · High cancellation/de-installation costs · Contractual obligations allowing access to your property · No benefit from selling power back to the municipality · No increase in property value |

Energy Bounce Back Loan

Once you’ve weighed up your options, the next big step is choosing a financing model that works for you. To assist households in making the move to solar power, the government has introduced the Energy Bounce Back Loan Guarantee Scheme, which enables banks to offer low-cost solar financing, says Du Plessis.

"Based on this scheme, we offer a Solar Loan with low interest rates that start at prime plus 1% and are capped at a maximum of prime plus 2.5%. This is a significant discount on the maximum prime plus 17.5% stipulated by the National Credit Act."

Standard Bank’s Solar Loan offers finance up to R300 000 and flexible repayment terms ranging from one to five years, with no penalties for early settlement. Its LookSee home efficiency platform also offers top-quality home solar installations supported by a free site visit and consultation with an energy advisor.

To make your home a contributor to a more sustainable world through solar energy, visit Standard Bank HERE.

Read more stories like this on Standard Bank’s Sustainable Impact hub below.

Explore More