How small businesses contribute to SA's economy

Starting and running your own small business in South Africa can be a daunting prospect at times.

But there has never been a greater and more challenging time for small business owners to use their agility, flexibility and determination to own their success and add value to South Africa’s economy.

When we look at the statistics, the contribution of small businesses to South Africa’s economy is huge.

The most recent annual statistics survey by Stats SA for 2019, showed that small businesses contributed approximately 22% of all business turnover in the country. That’s R2.3 trillion of a total R10.5 trillion.

In the same year, it was responsible for creating just over 10 million jobs. The ability to provide employment is one of the biggest ways that small businesses contribute to SA’s economy.

They are effectively the "wheels to the economy", that stimulate growth and add value to the country, says Viresh Harduth, Vice President, Small Business, Sage Africa and Middle East.

"Small businesses are agile and resilient. They are used to fending for themselves and if their potential is truly unleashed, they can take South Africa's growth to a whole new level. Small businesses are tough, flexible and hardworking."

Benefits for consumers

Consumers play a big role too when supporting small businesses, and there are benefits they accrue as well.

Besides the knowledge that they are supporting local people and caring about their community, they are also ensuring:

1. that money going into a small business contributes to the economy's GDP;

2. the small business grows and in turn, provides employment;

3. their purchases are likely to be unique and made-by-hand;

4. a smaller carbon footprint, contributing to the environment.

Owning your budget and cash flow

So what tips can small business owners glean to "own it" in South Africa?

Well, when it comes to business finances, keeping the cash flowing is one of the most important aspects of a small business, while "winging it" can be the worst strategy.

"Budgeting is critical. It helps you manage your finances and ensures that you’ve planned for recurring, but often overlooked, expenses, like insurance and tax. It also keeps wasteful spending in check and provides insights into where you can cut costs," says Harduth.

Saving and debt

Saving for a rainy day is crucial to the survival of many small businesses too, with many making the crucial mistake of building up debt to cover expenses when times are tough.

"Ideally, you should have at least three months' worth of expenses saved up. You’ll want to keep this money in an easy-access investment account, so that you earn higher interest but can also withdraw money at short notice."

"Don't, I repeat, do not use your credit card to cover big unexpected expenses. It’s likely that you haven’t budgeted for the extra repayments, which puts you back into cash flow-negative," stresses Harduth.

Red tape and tax

Another likely headache is the red tape and tax around setting up your small business. For many one-person businesses, where the owner extracts most of the income via loans and salaries, most in South Africa are not running at a profit.

"For them, well-targeted grants, less red tape and a focus on reducing other taxes (such as the fuel levy) might move the needle more effectively than a modest income tax cut."

Three things you can't go without

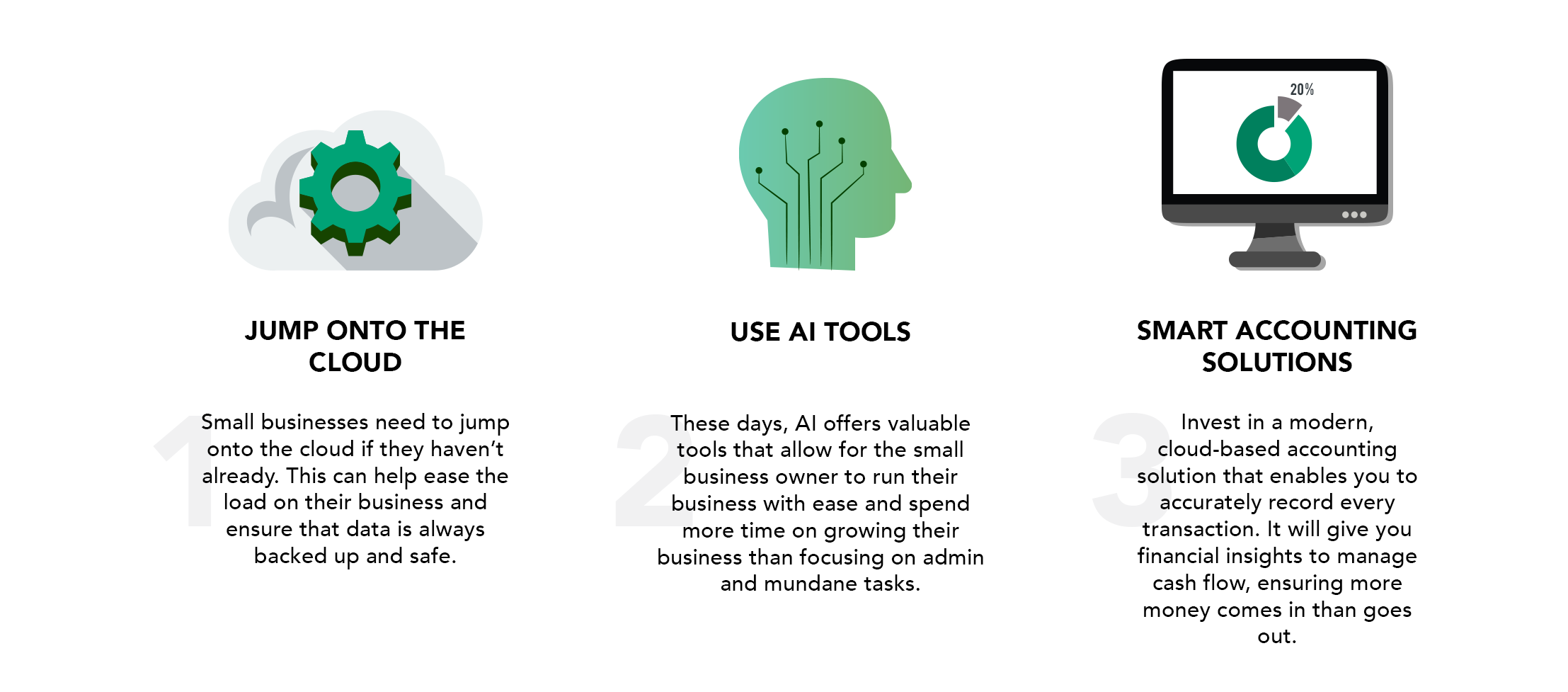

All small businesses want a headstart each year to give them that advantage they need. If there were three things your small business should own this year, they would be:

Attracting customers and investment

How can small businesses go about attracting customers, clients or even investors? Social media platforms such as Facebook and Twitter, and search engines like Google, offer an affordable cost of entry for advertising.

Strict budgets can be set so that you don’t overspend; you can target customers by location, interests and demographics; and you can also easily track how people share and interact with your content.

"Keep in mind that while social media can be useful, don’t forget about your connections offline. Networking is still a great tool to gain the trust of others and gather some referrals."

Apps and tools

While small businesses know their immediate needs well and how to get by, they shouldn’t ignore how the many, modern cloud-based apps can make their lives easier.

Cloud-based solutions give businesses and their employees more flexibility to serve customers from anywhere.

"Your finance and sales team can follow up on payments, order stock, create quotes and process orders, and access all sales information – on the go."

"What's more, cloud-based accounting systems automate a lot of these processes, freeing up your team's time to focus on more important customer-related tasks and services," adds Harduth.

Some of these tools include, Slack for communication and collaboration; Trello for project management; Buffer for social media; G-suite for file sharing; Google Analytics for web statistics; Evernote to organise notes; and MailChimp for email marketing.