COVID-19 HAS HIGHLIGHTED THE NEED FOR AUTOMATION

Covid-19 may have thrust the need for automation into the global spotlight - but much like e-commerce, it was a requirement that existed many years prior to the pandemic, that many ignored to their detriment.

As companies continue to reel from extended, and unavoidable, closures over the past few months, it's now clearer than ever that those who fail to automate key components of their businesses will lag behind.

AUTOMATION

NOT A NEW CONCEPT

Automation is nothing new, and for several years already, countries like Australia have shown how effective it can be. There, automation of mines in particular has shown how the increased usage of machines can improve safety and efficiency – and it’s this type of innovation that’s filtering down to smaller production lines and businesses.

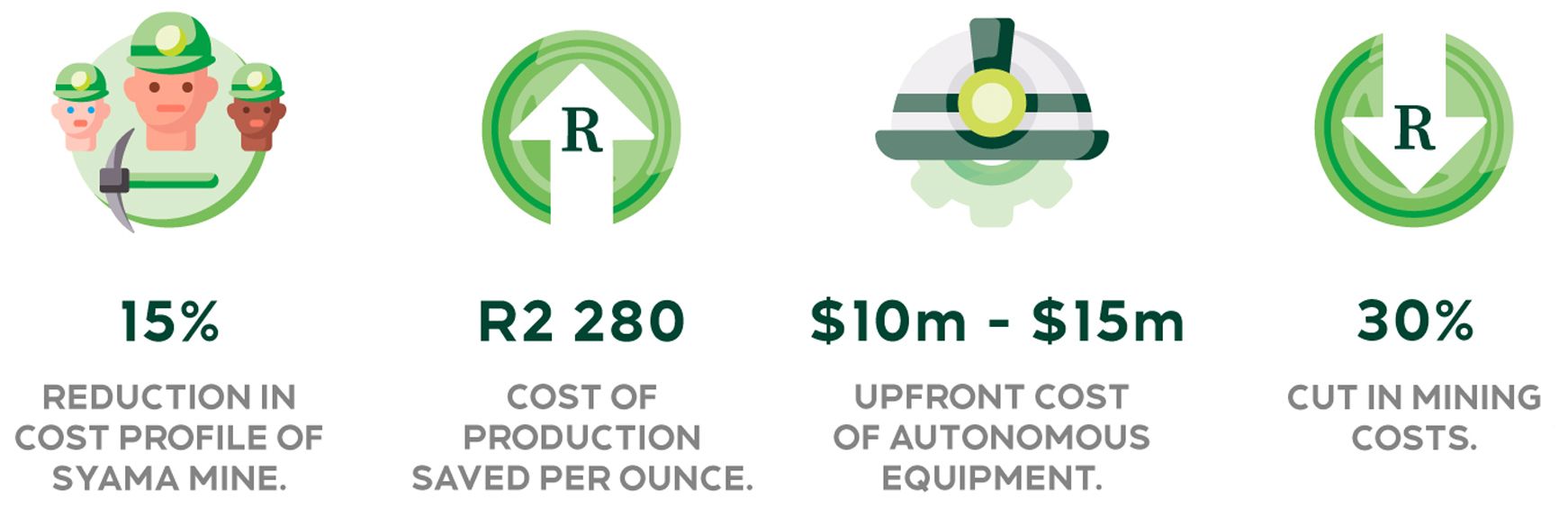

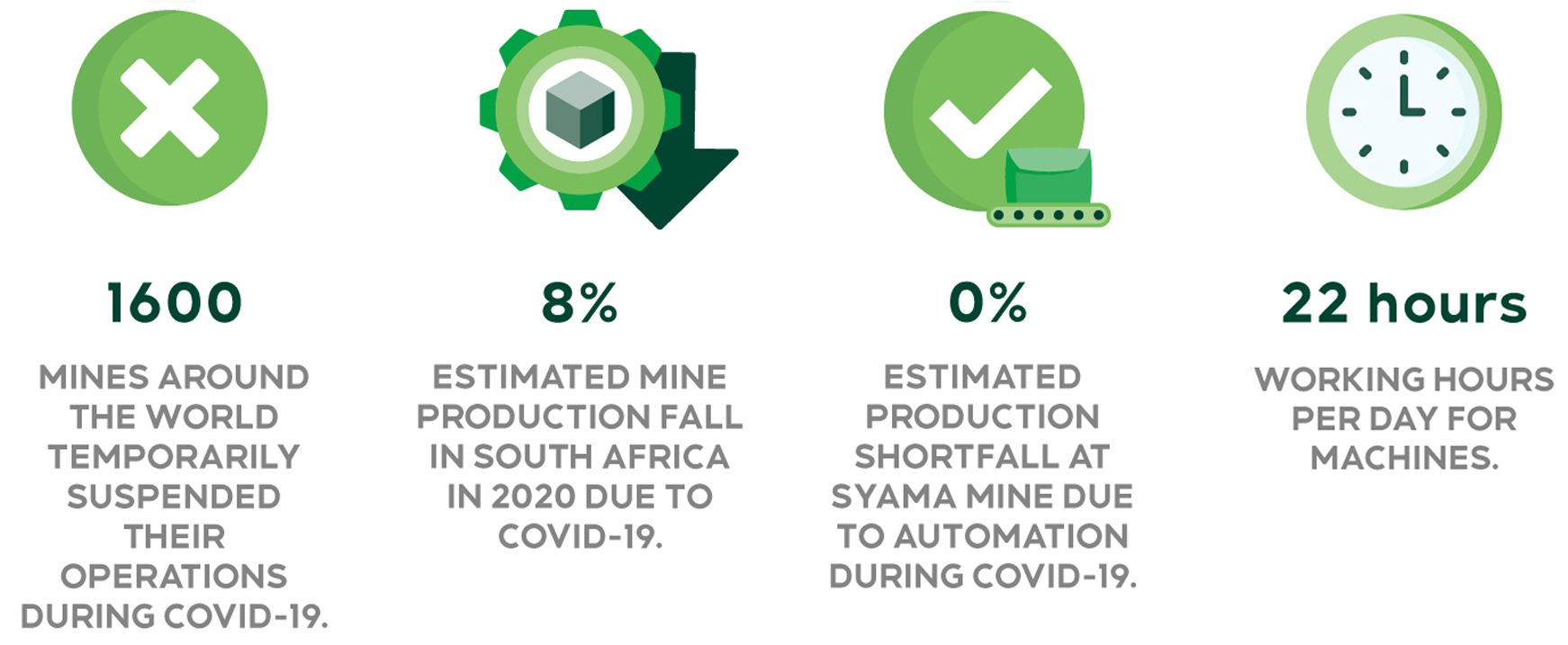

Australian-owned Resolute Mining’s Syama Mine - the world's first fully automated mine – opened in Mali in 2018. Aside from a marked increase in safety and efficiency in the lead up to 2020, Syama’s fully automated production model proved another critical point during the peak of Covid-19 – while other mines struggled to remain open and meet typical production levels, Syama continued as normal.

AUTOMATION AT A

SMALLER SCALE

Automation doesn't have to exist on this scale to be effective, though. And in South Africa, as companies grappled to find solutions to one of the world's strictest Covid-19 lockdowns, many of the interesting developments happened at a much smaller level, says Dr Hendrik Bohn, Head of Strategy at Nedbank Business Banking.

‘Larger companies thought about, explored and utilised automation long before Covid-19 - their sheer size and scale often make the smallest improvement highly beneficial,’ says Bohn. ‘But smaller companies often did not see enough benefits in it, due to their size.’

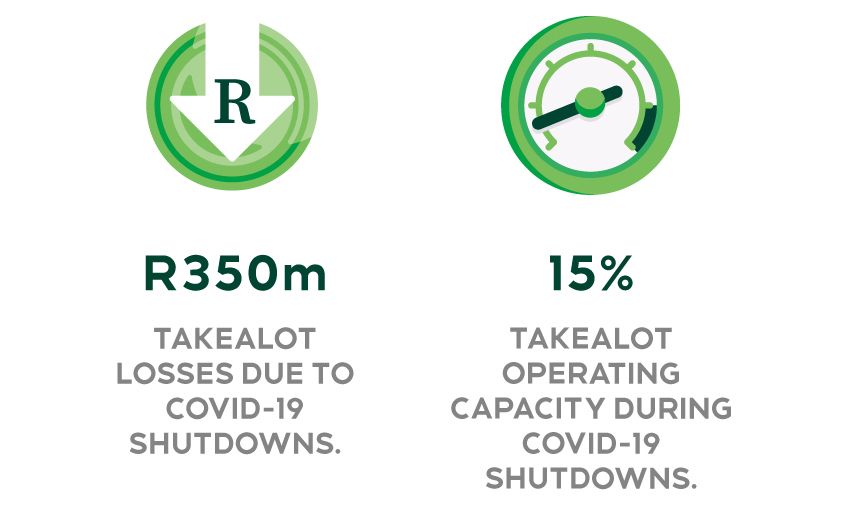

South Africa’s lockdown changed this notion almost overnight - and suddenly it was no longer about marginal improvements in efficiency, but about sheer survival. Nowhere was this more relevant than in the retail sector, where for small businesses to survive they needed to shift rapidly from bricks and mortar stores to facilitating online orders.

‘These orders needed to be processed, paid, packed, delivered, traced, and after sales needed to be facilitated,’ says Bohn.

Due to the short implementation time, many companies performed these tasks manually. But this led to errors and bottlenecks that resulted in unhappy customers and overwhelmed employees.

‘The only way to fix this was to automate at least parts of these processes - and it was not about driving efficiencies. It was about survival for many of these businesses,’ says Bohn.

In a moment of synchronicity, albeit most likely coincidental, Woolworths Australia announced in the midst of the pandemic that they intend spending up to AU$780 - several billion rand - on technology that will automate large parts of the group’s online order distribution centres.

At the time, group chairman Gordon Cairns said that the investments will increase their ‘capacity for growth, improve efficiency, advance localised ranging efforts, and deliver better and safer experiences for Woolworths stores, team, and customers.’

SMALL STEPS AND

MINIMAL INVESTMENTS

But not all automation investments need to be of this scale - at least not in the middle of a pandemic. Many of the automation developments in South Africa during the Covid-19 lockdown showed that meaningful automation can be done rapidly, in small steps, and with minimal investments.

‘There are a lot of cost effective tools and software available that can serve many business functions, such as order management, stock management, and payment management,’ says Bohn.

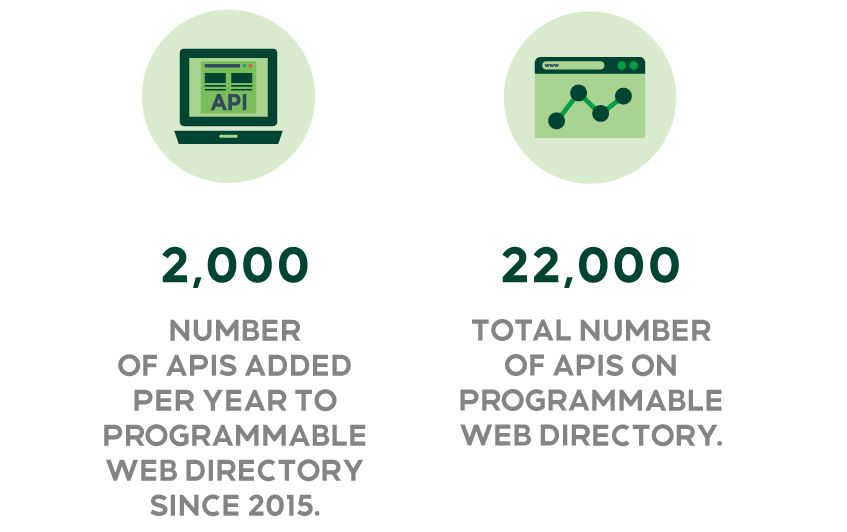

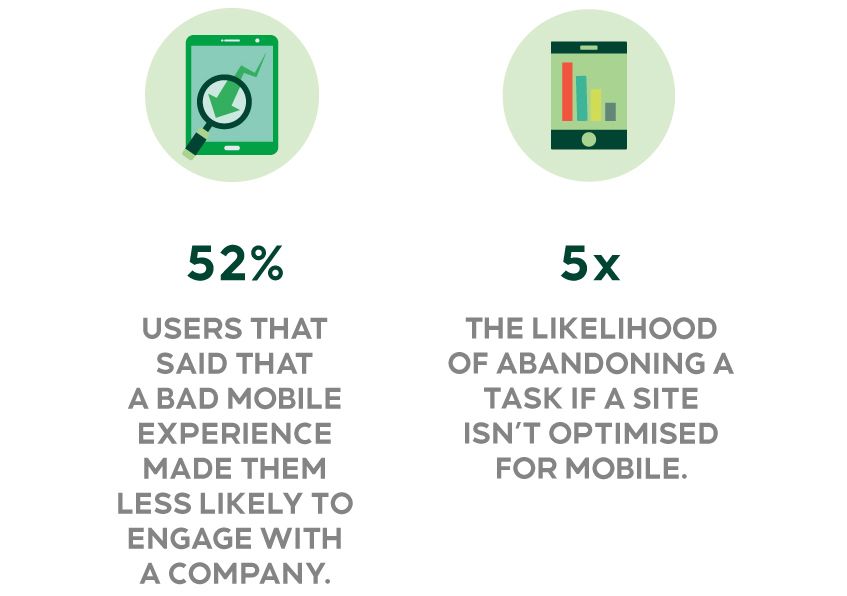

Application Programming Interfaces (API) provided by financial institutions, for example, can automatically handle complex tasks like payment processing, with the business needing little knowledge of complex coding. APIs make it easier than ever for online stores to improve the user experience for end users by plugging in to automated tasks - a critical factor in automating online shopping and closing sales. This is also true for mobile users, where many abandon shopping carts because of a poor user experience.

This type of automation, says Bohn, is cost-effective and highly efficient, and can eliminate inevitable human errors that may undermine operations.

Not all automation happens on an electronic or software level, though, and where hardware and machinery is required for automation the process can get significantly more complex and costly. But even in instances like these, Bohn says advances in technology like 3D printing and online on-demand manufacturing platforms are reducing costs, increasing efficiency, and can be implemented fairly quickly.

CONSULTING WITH

A TEAM OF EXPERTS

‘I think there is going to be this rise of companies asking “How do we automate our production?”, “How do we automate our processes in the future?’”, “How will this also ensure that we can continue our business operations without interruptions?”, says Nedbank Business Banking’s Mark Rose who is the Executive Head for New Business Development. ‘Because a lot of what has happened recently now is operations have come to a standstill.’

Although Covid-19 has brought the need for automation into the spotlight, Rose believes it’s a journey many businesses should already be on – particularly those that want to improve their efficiency and production outputs.

‘Automated production is a heightened response for companies, especially in manufacturing, to become far more efficient in order to compete in a global environment, where cost efficiencies are playing a much stronger role against a backdrop of lower production outputs,’ he says

And although achieving these objectives is a complex process, Rose says this is where the bank’s wealth of experts can assist.

‘At Nedbank Business Banking we've got specialists across various sectors that intimately know what businesses are going through,’ he says. ‘It gives business owners comfort that they're talking not just to a generic banker, but to someone who's specialised, who understands their industry, and who is backed up with bespoke and customised financial solutions for the challenges that they're going through.’

Bohn says Nedbank Business Banking can assist business growth in unpacking their automation needs, and where required, provide flexible solutions with which to finance machinery or acquisitions of existing producers.

‘In addition, we have a team of experts that co-create specific automation solutions together with our clients utilising internal capabilities as well as our vast network of clients and suppliers.’

Covid-19 has been devastating for most businesses, but the pandemic has also caused many to realise the importance of automation. And as an imperative for most businesses across all industries, there’s no better time than now to investigate the true powers of automation.